Digital signature registration in Net Banking - User Guide.

Introduction

High value transactions in SIB internet Banking are secured with second factor authentication. I.e., A real time One time password (OTP)/dynamic password will be sent to users registered mobile number via SMS, which needs to be entered to complete the transaction/critical activities.

As an alternate to SMS OTP model, we are pleased to present the option of Digital Signature Certificate for additional security of online net banking transactions

What Is Digital Signature Certificate?

Digital Signature Certificates (DSCs) are the digital equivalent (i.e electronic format) of physical or paper certificates. Examples of physical certificates are Driving License, Passport or Membership Cards. Certificates serve as proof of identity of an individual for a certain purpose; for example, a Driving License identifies someone who can legally drive in a particular country. Likewise, a Digital Signature Certificate can be presented electronically to prove your identity, to access information or services on the Internet or to sign certain documents digitally. DSC provides an additional level of safety and security for online banking transactions by digitally verifying the financial transactions and encrypting the information such that only intended parties can read it.

Who issues DSC and what are the different types of DSC?

A licensed Certifying Authority (CA) issues the Digital Signature Certificate. The CA is someone who has been granted a License to issue a DSC under Section 24 of the Indian IT-Act 2000. SIB Net Banking has been configured to accept USB token based digital signature certificate provided by e-mudhra certifying authority. After procurement of the DSC, the Certificate can be downloaded in to the hard token. Please ensure that the token drivers are installed on your system as guided by your Certified Authority (e-mudhra).

South Indian bank Internet Banking supports, Class 2 and Class 3 types of DSCs issued by e-Mudhra

Class 2 Certificates are issued for both business personnel and private individuals use.

Class 3 Certificates are issued to individuals as well as organisations. As these are high-assurance Certificates primarily intended for e-commerce applications, they shall be issued to individuals only on their personal (physical) appearance before the Certifying Authorities.

For more information, please visit: www.cca.gov.in , www.mca.gov.in

How to register for DSC based authentication in SIB Net banking?

- Submit a duly filled DSC application form to the branch for processing.

- Once the processing is over, plug-in the Digital signature USB token received from e-Mudhra CA in to the PC/Laptop and login to Internet Banking by entering User ID and Login Password.

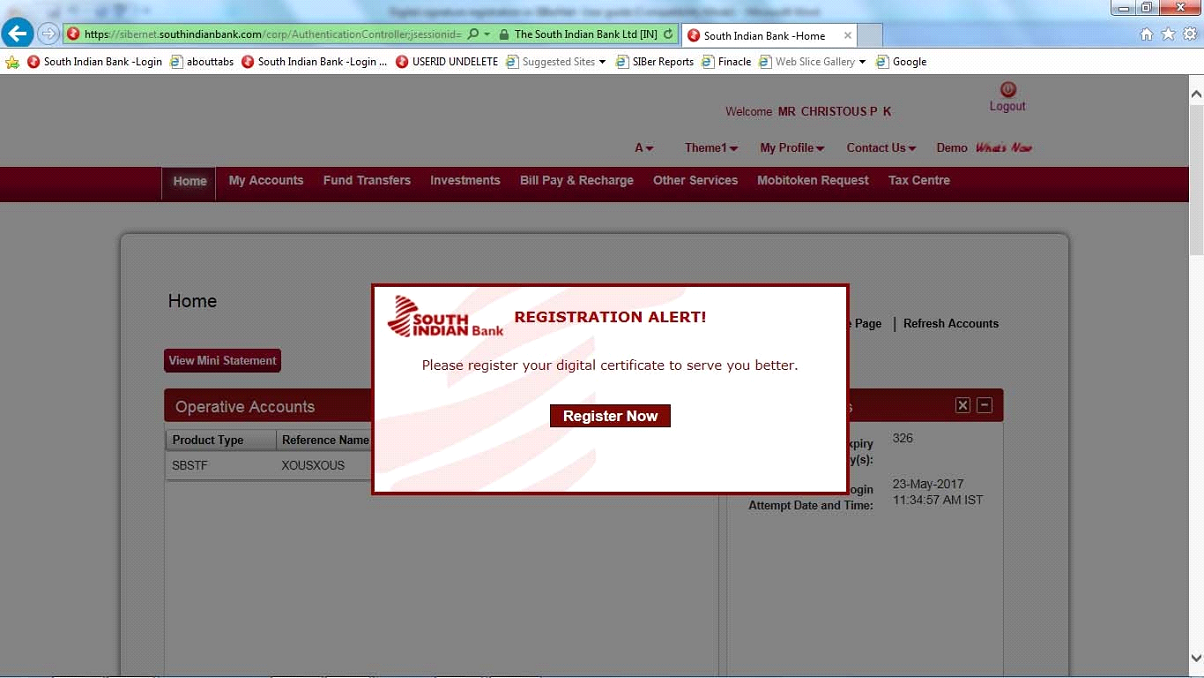

- User will get an alert "REGISTRATION ALERT" at the middle of the Login screen. Click 'Register Now' button to start the registration process.

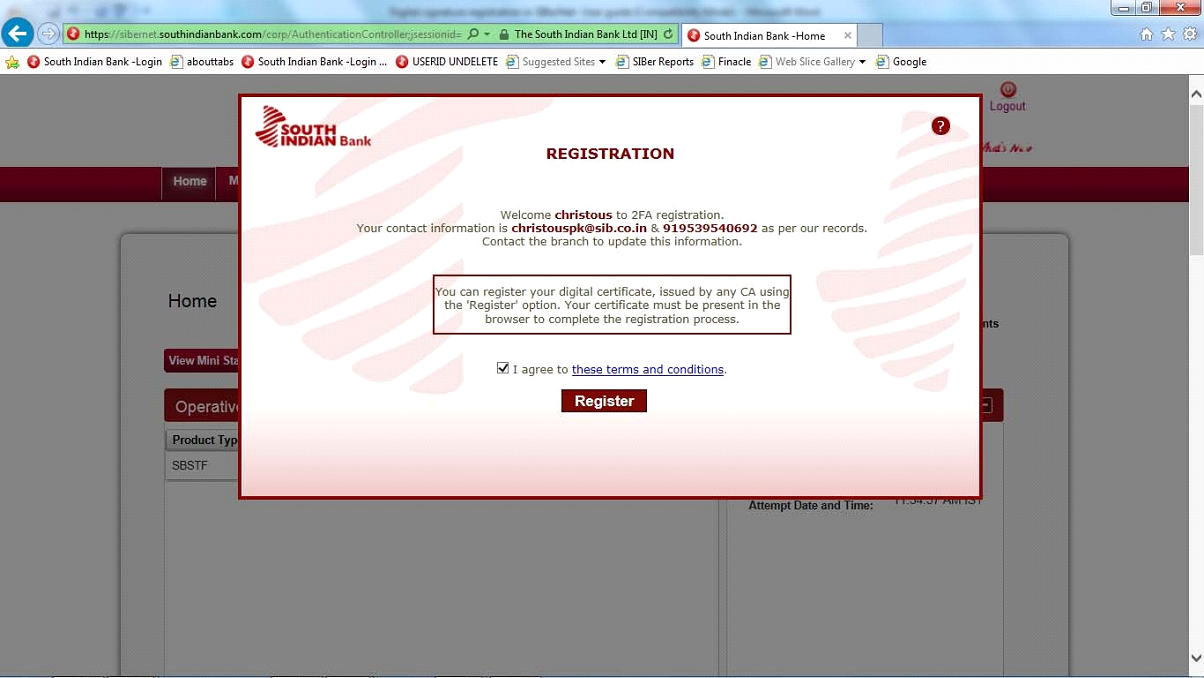

- Accept the 'Terms & Conditions' and Click 'Register' button in Internet Banking screen.

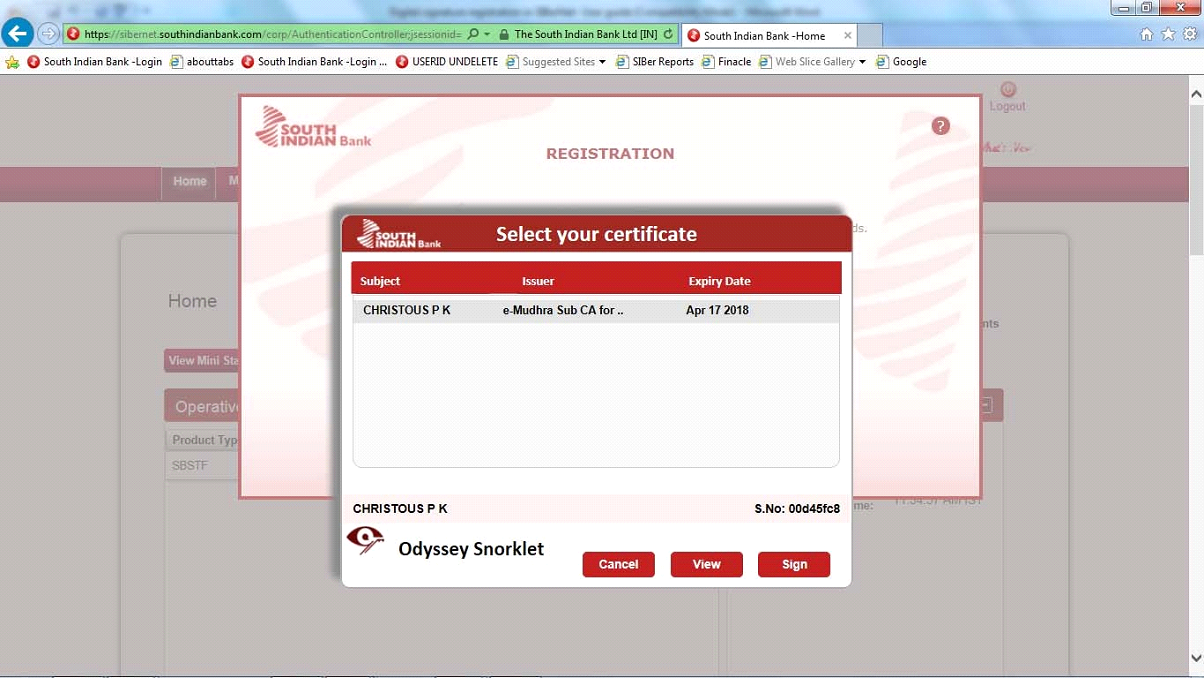

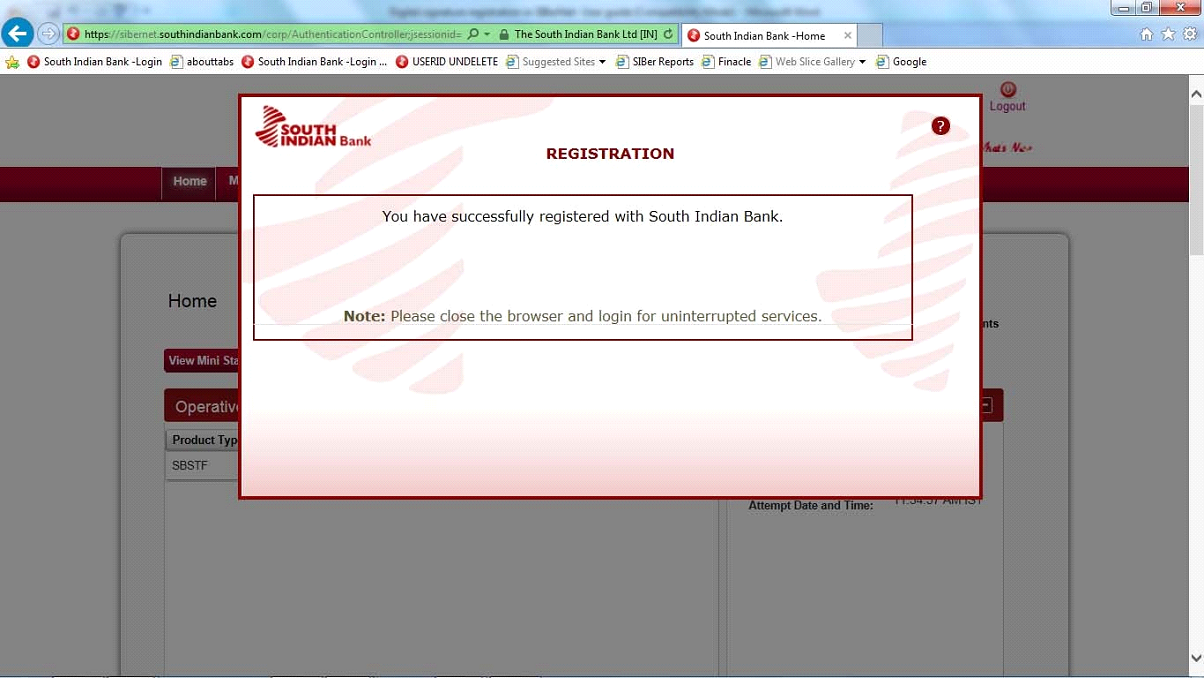

- System will identify Digital signature certificate (DSC) in the USB token and display it on the screen. Choose the digital signature and click on "Sign"

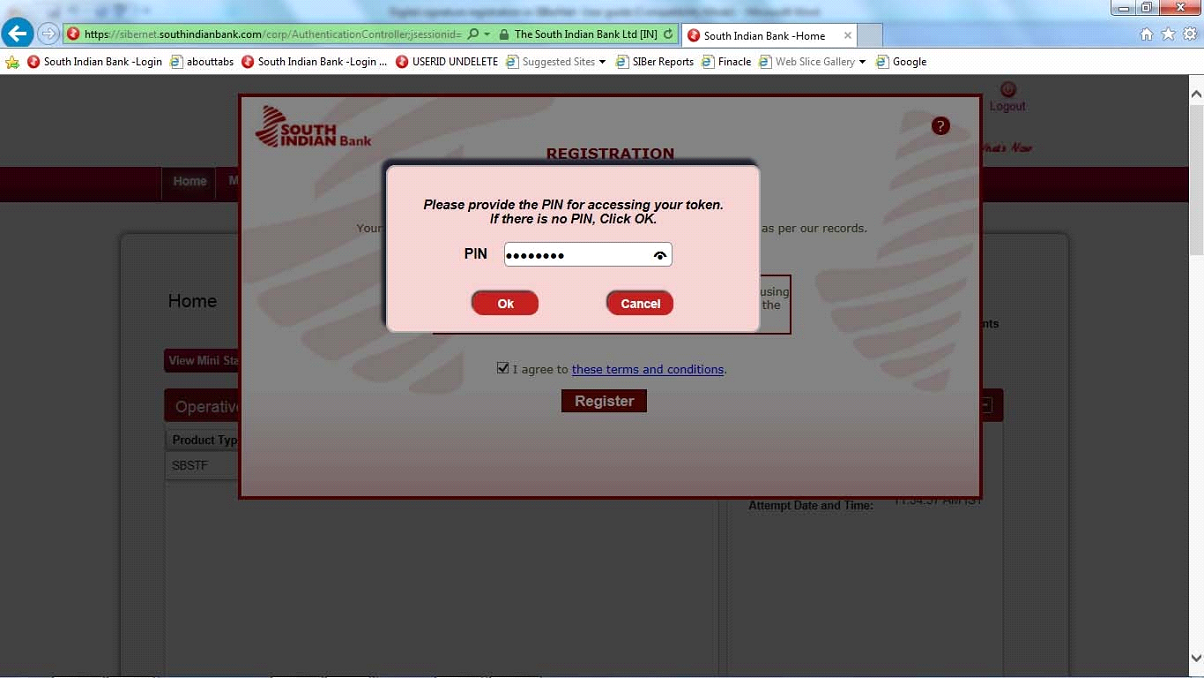

- Enter DSC USB token password and click "OK" USB token password:- Password configured while downloading/ activating digital signature into USB token.( Kindly Note: This may be different from SIB Net banking password)

- Digital signature registration is completed.

- Internet Banking Login

- Adding new Payee/Beneficiary

- Third party fund transfer

- External Fund transfer(NEFT/RTGS/IMPS)

- Online Bill payment/ E-commerce transactions

- Bill Pay & recharge services

After successful registration, Digital Signature based authentication is required for the following activities.

Internet Banking Login using digital signature

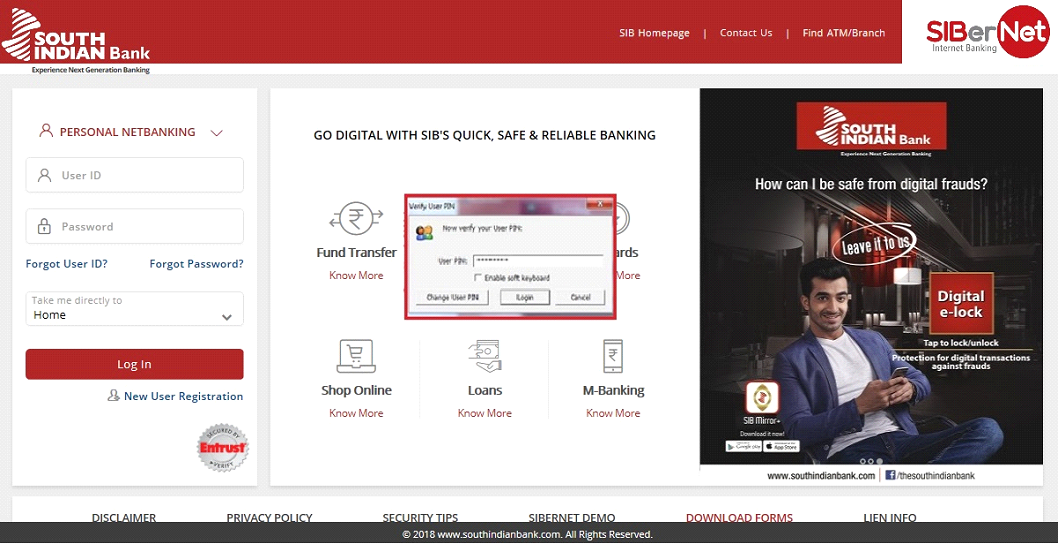

Log in to Net banking by entering User ID and login Password. A pop up box will appear and select the digital signature configured for SIB net banking.

User will get a prompt to enter "User PIN". Enter DSC token password in the field and click "Login".

Fund transfer using digital signature

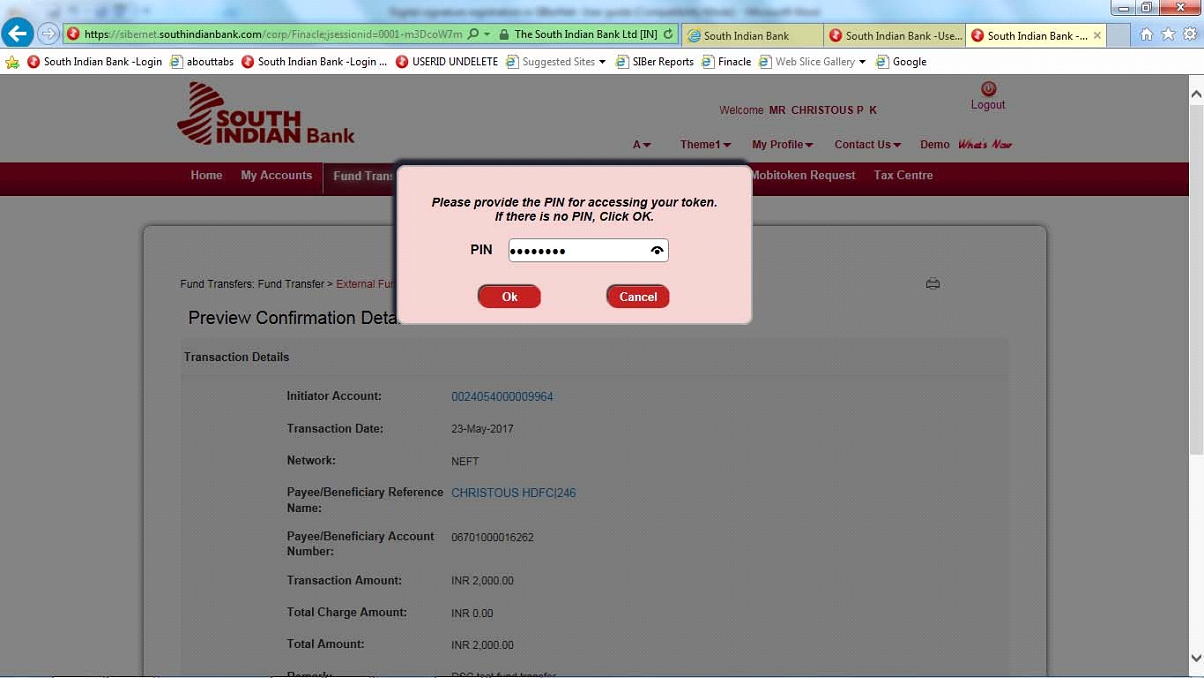

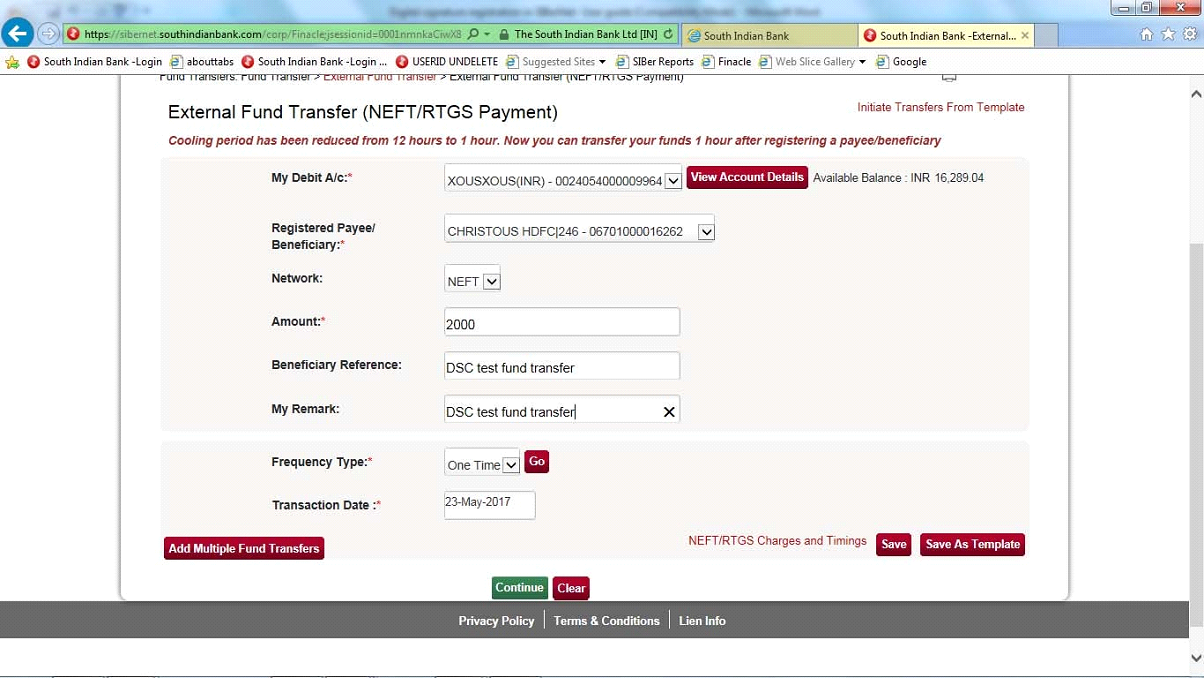

After entering transaction details click continue for proceeding to confirmation page

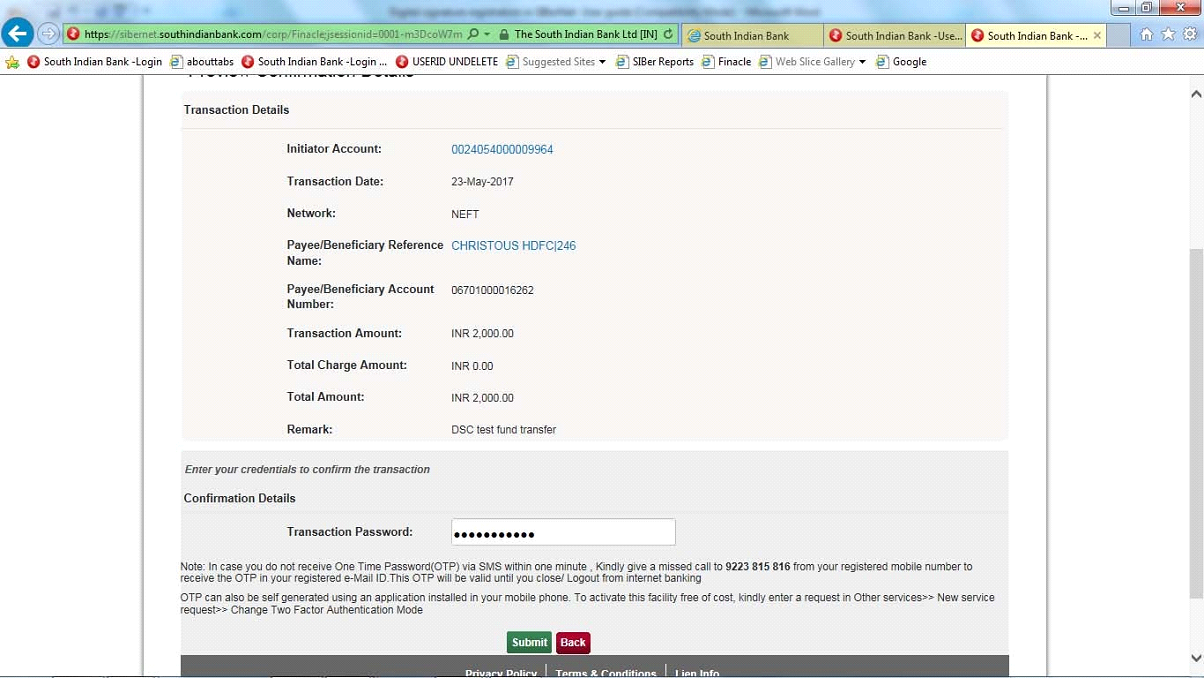

Enter transaction password in the confirmation page and click "submit"

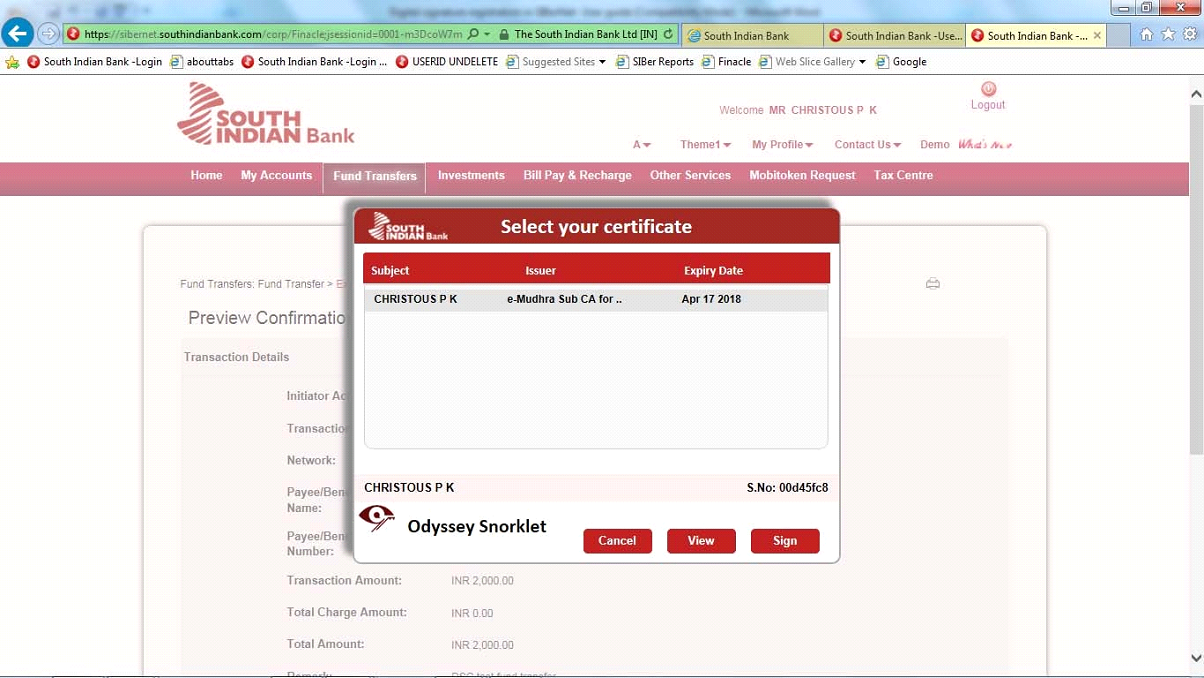

A pop up window will appear to choose Digital signature certificate. Select the DSC and click "Sign"

User will be prompted to enter DSC token password as authentication. Enter the token password and click " OK" to proceed to complete the registration process.